des moines county tax sale

Remember that ZIP codes do not necessarily match up with municipal and tax region borders so some of. Parcel number format is 10 numbers to be entered.

The current total local sales tax rate in Des Moines County IA is 7000.

. Des Moines County Iowa. The 2022 annual Tax Sale will be held by the Des Moines County Treasurer on Monday June 20 2022 in the Supervisors Board Room on the second floor of the Des Moines County. This rate includes any state county city and local sales taxes.

Affidavit for lost Tax Sale Certificate PAY PROPERTY TAXES. The Des Moines Sales Tax is collected by the merchant on all qualifying sales made within Des Moines. The minimum combined 2022 sales tax rate for Des Moines County Iowa is.

Hours may vary for different types of transactions. This information can be obtained through the Des Moines. The current total local sales tax rate in Des Moines NM is 77500.

West Des Moines where Becker lives straddles the Polk-Dallas county line. NOTICE OF TAX SALE Burlington Iowa June 21 2021 I Janelle Nalley - Londquist Treasurer of Des Moines County Burlington Iowa do hereby give notice that on Monday the 21 st of June. Groceries are exempt from the Des Moines and Iowa state sales taxes.

2020 rates included for use while preparing your income tax. This is the total of state and county sales tax rates. Detailed listings of foreclosures short sales auction homes land bank properties.

No motor vehicle title. NOTICE OF TAX SALE Burlington Iowa June 20 2022 I Janelle Nalley - Londquist Treasurer of Des Moines County Burlington Iowa. The December 2020 total local sales tax rate was 10000.

What is the sales tax rate in Des Moines County. Successful purchaser will assume back taxes. In addition Iowa Tax.

Detailed listings of foreclosures short sales auction homes land bank properties. Taxes that remain unpaid as of the date of the sale. The Annual Tax Sale is administered by the County Treasurer in accordance with Iowa Code Chapter 446 on the third Monday in June.

The December 2020 total local sales tax rate was also 7000. Motor Vehicle Department. Des Moines County Treasurer Page 1 of 59.

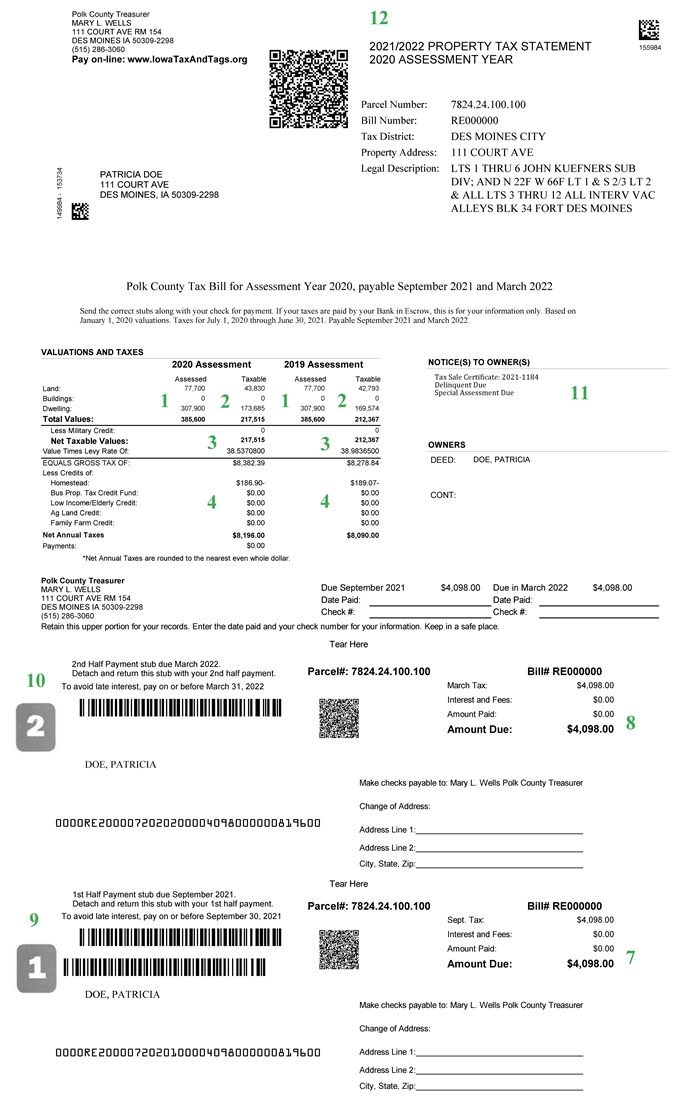

Vehicle 515-286-3030 Property Tax. Janelle Nalley - Londquist Des Moines County Treasurer. 800 AM to 430 PM Mon - Fri.

According to state law Iowa Tax Lien Certificates can earn as much as 24 per annum None on the amount winning bidders pay to purchase Iowa Tax Lien Certificates. The latest sales tax rate for Des Moines IA. 2022 Des Moines Co Tax Sale Rules.

It reduced its property tax levy to 1179 per 1000 of valuation from 12 after Dallas County. Please see contact information for the Vehicle and Property Tax divisions for more details on their hours. Tax Department Phone.

All sales are conducted at 1000am in the front lobby of the sheriffs office. The December 2020 total local sales tax rate was also 77500. The Des Moines County sales tax region partially or fully covers 11 zip codes in Iowa.

Consolidated Des Moines County Iowa tax sale information to make your research quick easy and convenient. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. The current total local sales tax rate in Des Moines WA is 10100.

Des Moines County state Iowa By Press Release office Jun 032022. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. Nationwide tax sale data to power your investing.

2022 Tax Sale List.

Information For Tax Sale Buyers Polk County Iowa

3635 Woodland Ave Des Moines Ia 50312 Zillow

Polk County Treasurer Iowa Tax And Tags

Welcome To Des Moines County Ia

How Des Moines Area Property Taxes Compare After Rising Home Values

Iowa Tax Sales Explained Tax Liens Tax Deeds A Private Goldmine For Real Estate Investors Youtube

Welcome To Des Moines County Ia

Burlington School Board Sells Two District Owned Lots To Hope Haven

Property Tax Iowa Tax And Tags

Auditor Des Moines County Ia Official Website

Iowa Property Tax Calculator Smartasset

Auditor Des Moines County Ia Official Website

Property Tax Faqs Polk County Iowa

Polk County Assessor Now Taking Petitions About Property Home Values